Invest With Us

Targeting Core-Plus, Necessity-Based Retail

Four Front Real Estate Partners is focused on acquiring and enhancing open-air retail centers anchored by essential, daily-needs tenants. Our strategy centers on identifying underperforming or overlooked assets in high-growth, mid-sized markets where we can unlock long-term value through leasing, repositioning, and operational improvement.

We specialize in core-plus retail — assets that deliver stable cash flow with clear value-add potential. These properties are trading at favorable cap rates relative to other asset classes, offering attractive risk-adjusted returns.

Our Approach

We pursue a disciplined, four-step strategy:

Acquire

underperforming or mismanaged properties in prime or transitional locations with embedded NOI upside

01

Unlock

value through targeted capital improvements, operational efficiencies, and proactive lease-up

02

Upgrade

tenant mix via anchor repositioning, expansion, or repurposing of underutilized space

03

Stabilize

assets for long-term hold or disposition at a premium

04

Where We Invest

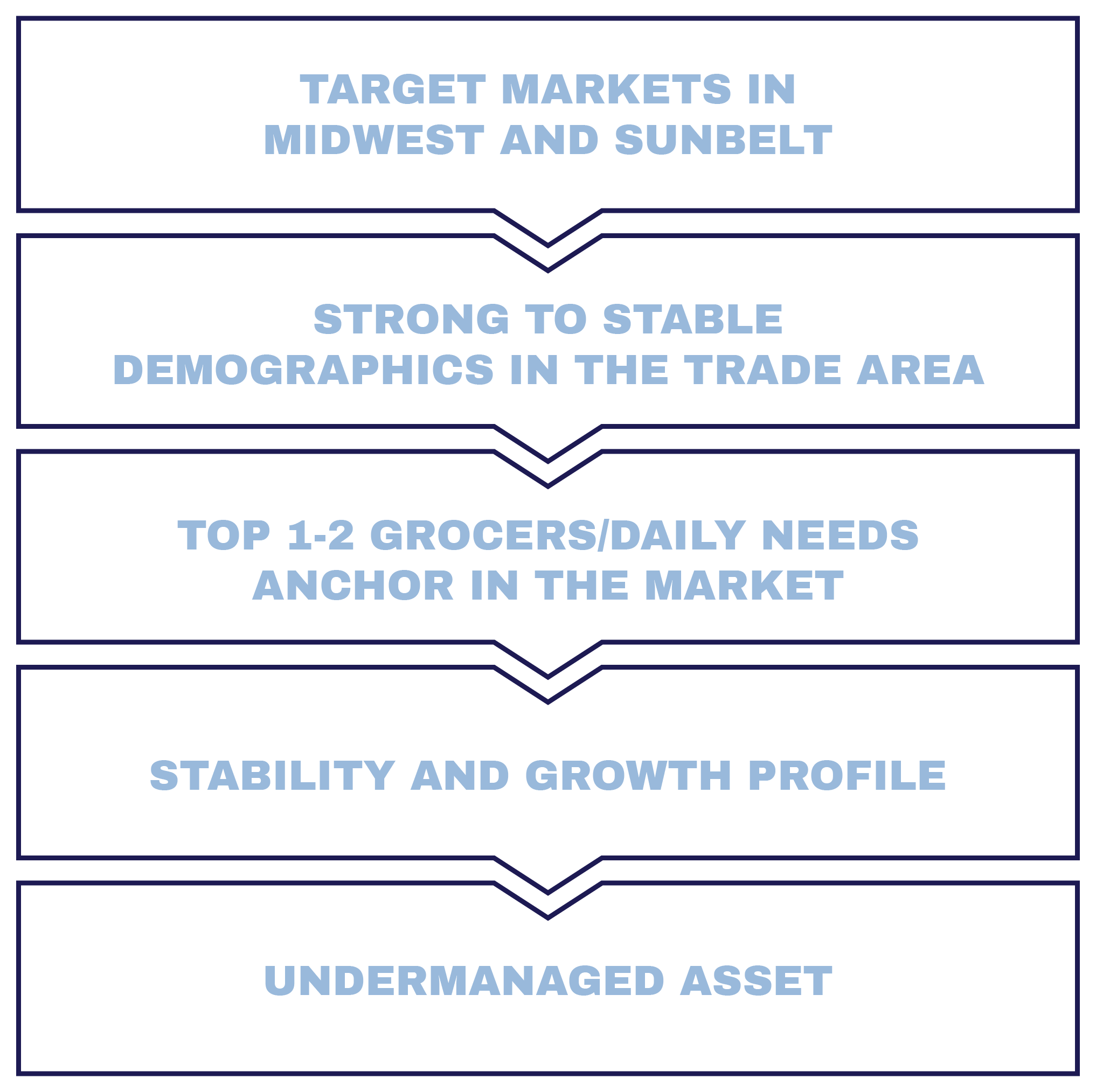

We focus on mid-sized U.S. markets in the Sun Belt, Southeast, and Midwest that are often overlooked by larger institutional capital.

AL, AR, GA, FL, IA, IL, IN, KY, MI, MO, MS, NC, OH, SC, TN, VA, WI, WV

These markets demonstrate strong demographic trends, durable consumer demand, and long-term growth potential.

Target Markets Include:

Our Investment Criteria

Grocery-anchored, necessity-based open-air retail assets with a focus on value-add opportunities (i.e. below market leases, vacancy lease-up, pad development and/ or repositioning of underutilized space, etc.)

Key anchor tenants (i.e. grocers, home improvement, discount retailers) must be a leader in the market/submarket (ranked 1 or 2 in sales productivity/profitability)

Long-term lease profiles with minimal soft goods/fashion exposure

Deal size: $15MM - $35MM per acquisition

Property Profile

Interested in Learning More?

Complete the form below to access our investor deck and learn how Four Front Real Estate Partners is capitalizing on opportunities in core-plus, necessity-based retail.